* Please refer to the English Version as our Official Version.

* Please refer to the English Version as our Official Version.

According to statistics from TrendForce Ji State Consultation, the total shipments of MLCC suppliers from January to April this year were 1359 billion, a decrease of 34%compared with the same period of 2021, showing that global economic issues have a greater impact on the MLCC industry.

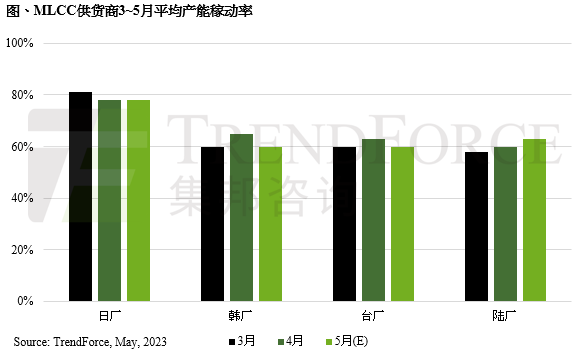

Since the second season, due to the undulating demand of the brand and ODM orders, and the continuous pressure of price reduction, the MLCC supplier continuously controls the reduction of production capacity to maintain the balance between supply, inventory, and price.In May, the average capacity of the Japanese factory production capacity was 78%; land factories, Taiwan factories, and Korean factories were about 60 to 63%. With the continuous downturn of terminal consumption demand, suppliers' production reduction and carriers may become short -term normal.

From the perspective of MLCC's main market, in terms of mobile phones, the new machine launched by Huawei, Honor, and OPPO in the second season cannot effectively boost market spending power, resulting in brand factories more conservative for new product sales plans.In terms of servers, the current shipping volume is estimated to be 2.85%year -on -year, and it may be possible to repair it in the future. ODM material inventory is affected. As of the end of AprilDon't wait for 4 to 8 weeks.

The PC and laptop market, because of the three -year change season of once every three years since the epidemic, ODM has begun to mass production and shipping the new platform of RAPTOR LAKE CPU, regardless of consumption or business models.From Guangda and Renbao's top two ODM foundries in April announced the shipments, only 3.3 million and 2.4 million, even close to the impact of the outbreak of the epidemic in the same period last year.Below, 3.2 million and 2.2 million numbers paid.In contrast, today's performance is explaining that the current consumer market demand is sluggish, and the economic prospects are unknown, which makes OEM conservatively viewing the sales forecast for new products listing.

TRENDFORCE Jibang Consulting further stated that the market has previously believed that inventory pressure is the main reason for impacting the MLCC industry.The second quarter of this year has gradually returned to normal. From time to time, there is an emergency and short -order inventory. However, the overall pressure is still lost to the downturn in the consumer market.In May, the MLCC supplier BB Ratio (Book-to-Bill Ratio; order shipment ratio) was 0.85, only 0.01 slightly over April, and the order growth was extremely low.

Looking forward to the third quarter, although the brand factory and ODM still hope that the traditional peak season can stimulate demand recovery, the amount of MLCC forecast for suppliers is substantially released, and the growth rate is still low, and the performance of the traditional peak season has not been seen.It is worth mentioning that the iPhone 15 new machine preparation order for the iPhone 15, which is expected to be listed in the third quarter, is recently more than the same period of last year.Still attractive.